Laws surrounding spousal support, also known as alimony or maintenance, have recently undergone major changes when it comes to taxation. According to current Illinois law, recipients of spousal support no longer need to claim it as income, and payors may no longer deduct alimony on tax forms.

Alimony is awarded to one spouse during or after divorce, especially in cases where the two spouses have significant income discrepancy. Higher-earning spouses financially support lesser-earning spouses. The goal of alimony is to create financial equality between divorcing spouses after divorce.

What are the three types of alimony in Illinois?

Temporary alimony is common and allows a divorcing spouse to maintain the financial status quo as divorce proceedings continue. Illinois judges evaluate each spouse’s income before deciding on temporary alimony. Support may end when the divorce is finalized.

Rehabilitative alimony can continue for an extended period of time. A divorcing spouse may receive alimony while he or she gains job-related skills and is able to financially self-support. This long-term alimony may end when, upon a judge’s review, the recipient becomes financially independent.

Alimony can also be permanent. One spouse may be ordered by a judge to pay permanent alimony to a spouse who is unable to self-support after divorce. Causes for a lack of financial independence may include chronic illness, age, and various additional factors.

In instances where both divorcing spouses are financially independent, alimony may be denied. This may be the case even when large income discrepancies exist. The courts may instead award marital property, such as mutual funds or bank accounts, in lieu of direct financial support to a lower-earning spouse.

What are tax implications of the Tax Cuts and Jobs Act (TCJA)?

Whether a spouse is ordered to pay temporary, rehabilitative, or permanent alimony, tax implications exist. A new spousal maintenance law, reflected in Section 504 of the Illinois Marriage and Dissolution of Marriage Act (IMDMA), was enacted by the Illinois legislature, and went into effect on January 1, 2019.

In response to the TCJA, Section 504 of the IMDMA includes two major changes: 1) Illinois family law judges assess the divorcing spouses’ net annual income after taxes to determine maintenance costs; and 2) the amendment changes the percentage used to calculate annual alimony payments.

Under the new law, the formula for calculating annual maintenance is based on the payor and payee’s net rather than gross income. Annual maintenance payments are calculated by the following formula: 33.3 percent of the payor’s net income minus 25 percent of the payee’s net income.

As before the new law was enacted, the duration of alimony payments is determined by the length of marriage multiplied by a specific statutory factor (for example .20 for under 5 years of marriage or .40 for more than 9 but less than 10 years of marriage).

Based on this amendment written into the IMDMA, spouses ordered to pay alimony are no longer able to deduct spousal support costs on federal and state tax forms. Additionally, the spouse receiving alimony is not required to report the financial support as taxable income.

What factors now impact court decisions about alimony?

Since the amendment was passed, Illinois judges who examine divorce cases are required to consider several factors to abide by Section 504 of the IMDMA. Written into the IMDMA are fourteen factors that influence the courts’ verdicts about alimony.

The income and property of each spouse are considered, as well as the financial obligations of the divorcing parties that result from the dissolution of the union. Each spouse’s needs are evaluated. A realistic assessment of the spouses’ future earning capacities are determined by the presiding judge.

An Illinois judge will also take into consideration the efforts of one spouse to maintain the marriage and household by delaying educational and career opportunities. Impairments of realistic current or future earning capacities are given a close examination by the courts.

During marriage, a standard of living is established. The judge looks at this, while also considering the length of the marriage. Valid agreements between the divorcing couple are examined. The courts also consider each spouse’s age, employ-ability, income, and liabilities.

Furthermore, a family law judge assesses each party’s public and private income, which may include disability or retirement income. Property division may incur tax consequences, and the courts examine the situation. Any other just and equitable factors are heavily considered by the judge.

Since the spouse providing maintenance must now pay taxes on the alimony and the support is no longer included in the payee’s taxable income, divorcing spouses may question how the new law benefits them. The new law may favor neither party since less money is available to split in divorce.

However, the payer of spousal support is often in a higher tax bracket. The new law will cost the payor more, given that he or she is now responsible for paying taxes on the support payments. This allows the government to receive more in taxes from the higher-earning spouse.

Work with a Divorce Attorney

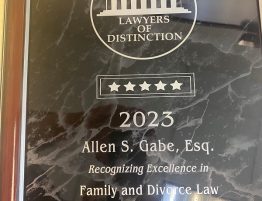

Matters of alimony can be a challenging road to navigate. When you seek spousal support, you will benefit from expert legal counsel. Turn to the reputable divorce attorneys at Allen Gabe Law, P.C. We’ll present a strong case in court, so you receive your fair due.

Our legal team also represents spouses who plan to avoid or limit paying spousal support during or after divorce. Experienced divorce attorneys from our firm listen to the details of each case to present clients in the most favorable light in court and reach an agreeable settlement.

Whether you are a high earner or fall into a lower tax bracket, the divorce attorneys at Allen Gabe Law, P.C., will skillfully build your case. We continually stay updated on the changing Illinois laws that affect divorce so we provide you with qualified legal guidance.

When you require legal expertise to help negotiate a settlement in court, trust the experienced divorce lawyers at Allen Gabe Law, P.C. We have successfully handled countless divorce cases involving spousal support. Our firm serves the legal needs of residents in Schaumburg, Illinois.

Call 847-241-5000, ext. 121 for a consultation.